2/1/2020

What’s a Business Worth?

Bill McCurry

“This is the most frequently asked and hardest to answer question,” says Gene Redlin, operator of Byron Nursery and a certified appraiser at Redlin & Associates that provides Horticultural Expert Valuation Services. “We have to tell people the hard truths. There’s no guaranteed formula that works for every situation or every time period.”

Here are some valuation methods:

Salvage Value: Worst-case scenario. It’s what the assets bring when auctioned off or sold to vultures for immediate cash. Too often, trash-hauling costs exceed the asset’s salvage proceeds.

Replacement Value: Better than salvage. The assets have value when productively used. The buyer’s question is, “What would I pay for these same assets on the open used market and what are the transportation/set-up costs?”

Going Concern and EBITDA: “Going Concern” means the assets will be used for a continued generation of profits in the same/similar industry. A greenhouse with existing curtains, irrigation, benches, etc. has a higher value to another grower than to someone wanting the greenhouse for storage.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is the most talked-about methodology. The business valuation equals the annual EBITDA multiplied by a factor.

Gene says, “Six times EBITDA is a starting point. We arrive at the final pricing after numerous up and down adjustments. There are many ‘soft features’ beyond just proven historical earning capacity.”

Does the buyer have confidence in the seller’s financial records? Differences between cash accounting and accrual accounting can create differences in EBITDA. Beyond EBITDA, look at operating profit and cash flow. Be sure to understand the financial ramifications of each major EBITDA input.

“Games can be played,” warns Gene. Many sellers will “recast” their financial statements, adjusting for owners’ discretionary expenses deemed unnecessary to the buyer. The result is higher EBITDA, meaning a higher selling price.

More to Think About

What’s listed above are historical financial analyses. Do assets need to be replaced, remodeled or repaired? Immediate Capital Expenditures (CapEx) require the buyer to have cash available, a possible deduction from selling price.

The existing owner’s track record defines the business’ capability. Buyers dismiss the “you can run this business better than I did” rationale for a higher selling price. If there’s potential growth, the seller’s position should be, “Were I in a position to invest more, I’d do …” This implies the business has an upward scalable momentum the investing buyer can capitalize on.

An owner intimately involved in all relationships with key customers/vendors challenges a buyer to assume those relationships. Gene says, “Solid bench strength gives a buyer confidence the business can continue without the seller’s personality.”

What’s the work force’s quality/stability? Key team members must be committed to remain through the transition. Rumors may scare the best employees into “jumping ship,” fearing the business will be sold. If the buyer wants an ongoing business, it may be necessary to offer incentives to maintain the team for six to 24 months. These incentives could be paid by the buyer, the seller or both. How important is the existing team or key team members?

What’s the work force’s quality/stability? Key team members must be committed to remain through the transition. Rumors may scare the best employees into “jumping ship,” fearing the business will be sold. If the buyer wants an ongoing business, it may be necessary to offer incentives to maintain the team for six to 24 months. These incentives could be paid by the buyer, the seller or both. How important is the existing team or key team members?

Are there customer or supplier concentrations of income that can be easily transferred to a new owner? One unaware CPA reviewed a seller’s books and determined there wasn’t a “concentration” of sales with any one customer. What the accountant missed was over 20% of sales came through non-profit money raisers spread among five different organizations. When the non-profits decided to try a different garden center, the buyer was immediately and significantly impacted.

What intangibles are present? Is the business in an area of rising real estate values? If yes, the real estate ownership could be an upward adjustment in the selling price. If the real estate is rented, that could be a downward adjustment because of probable rent increases. Is it a neighborhood of new homes needing plants or mostly apartments with minimal landscaping?

What’s the company’s history of legal/regulatory issues? Is it current with all required paperwork from DOL, EPA, OSHA, IRS, etc.? A competent buyer, even if not legally liable, is concerned with contingent legal liabilities, as well as potential PR nightmares.

Who’s the clientele? A stable of loyal, high-income customers, tending to spend during economic downturns, is worth more than moderate-income customers.

The Importance of Accurate Assessment

Business brokers can offer many services, including finding buyers or sellers the average person can’t reach. All things are negotiable, including commissions rates and whether paid by buyer or seller. When negotiating, be certain you’re paying enough to get the attention of commissionable people. Many sellers feel the broker gets a significant commission if they put the seller into a “bad deal.” Trust in your broker is a critical component. If you negotiate a low commission, but get a bad deal, what have you saved?

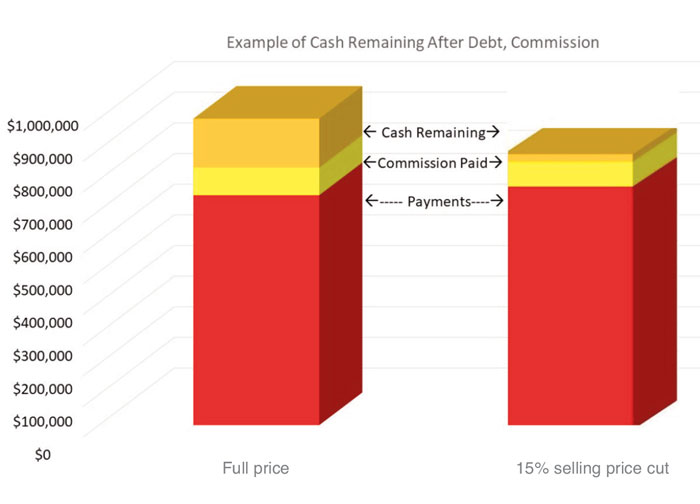

Whenever selling a business, compute the estimated cash remaining after all final payments. Many sellers are surprised when they add up all the costs, many of which are surprises. These include termination fees, commissions, accrued vacation, severance packages, outstanding loans, leases, bills, etc. The chart shows a $1 million sale. The $750,000 figure represents payments due to non-owners. With a 9% commission on a full price sale, the owner(s) walks away with $160,000. If the owner discounts the business selling price only 15%, the owner nets $23,500.

Price the business fairly. Be realistic in your assessments. It’s unfortunately common for sellers to end up having nothing left after paying all the costs they hadn’t realized existed.

Don’t Go it Alone

Both buyer and seller need competent professional assistance structuring the deal for tax/legal issues. Some aspects of the deal may be more valuable to one party than the other, i.e. rent, consulting, licensing of intellectual property, covenant not to compete, etc.

The myriad inputs into the final selling price of a business revolve around each party’s dreams, their understanding of the potential and willingness to act. Negotiate the best deal you can. After the deal’s done, move on without second guessing if it were the best possible deal for you. Focus on generating a positive future with what you gained from the transaction.

Hydroponic Growing to Garden Center: A Fair Market Value Transaction

Kate Terrell and her father, Doug Nelson, discussed whether to sell or close their second Wallace’s Garden Center location in Davenport, Iowa. The location, suffering from a lack of on-site management, needed upgrades. Kate preferred concentrating on their Bettendorf, Iowa venue, where she could be nearer her family, rather than investing in the second location. “We were making money. It was too profitable to close, yet too consuming to keep operating,” she adds.

They listed the property. Prospective buyers looked, evaluated the costs to remove Wallace’s infrastructure and didn’t buy.

Meanwhile, Chen and Andrew Freitag, husband and wife owners of Friday’s Fresh Market, needed expanded growing facilities for their smart city farming, vertical growing of leafy greens for local consumers. Their product consistently sold out. They also needed their own retail destination. Wallace’s ready-for-move-in infrastructure would save time and money.

Doug and Kate weren’t panicked about selling. The Freitags had been looking and could continue to look. Both saw the value they would bring to the other party. The Wallace’s team made historical information available for evaluating the operating costs. The transaction price was the classic definition of fair market value: the price determined by a willing buyer negotiating with a willing seller, both having full knowledge of all relevant facts and neither under compulsion to act.

Wallace’s had the option to continue operating the center (albeit at a personal family cost, plus additional investment) and the Freitags had the option to continue looking at other locations.

The established Wallace’s family wanted all cash; the Freitags being in growth mode wanted to conserve cash. They got a bank loan to buy the operating business; Wallace’s financed the real estate.

Instead of buying “the business,” the Freitags acquired many of Wallace’s assets, allowing an instant start-up with a built-in base of customers and vendor relationships. The Freitags had minimal garden center experience; Wallace’s personnel had generations of operational experience. Chen characterized Doug as “a legendary growmaster. There isn’t anything he couldn’t teach you.” Doug and Kate have consistently coached Chen and Andrew, guiding them at trade shows, counseling them about buying and forecasting, and teaching the myriad details of running a garden center.

There’s language in the contract stipulating the “seller” will give advice to the “buyer.” Chen says, “The people are more important. Contracts come from lawyers. People understand the intention.”

Originally, Mr. Wallace had guided Doug. Now Doug and Kate continue that tradition. Chen says, “Their help is invaluable because there’s no mercy in the marketplace.”

While neither buyer nor seller got exactly the terms they wanted, there was give and take, positioning both sides for success.

The Vision Lives On: Willow Ridge Garden Center & Landscaping

The late Pete Craven was an investor in Willow Ridge Garden Center & Landscaping (Oak Ridge, Tennessee) and became the sole shareholder. A great citizen and a fantastic employer, he saw how a well-managed nursery and garden center could be a superb investment.

To keep key employees engaged, Pete gave them shares of stock. These employees had 20-plus years of experience working together. “I can’t recall a major disagreement. There was never anything we couldn’t talk through,” reflects Gene Marlow, the current president and a benefactor of Pete’s generous philosophy.

Gene became president when Pete’s successor, Tom Lakers, retired last summer. Based on a formal buy/sell agreement written years ago, the transition was administratively smooth with no surprises.

Pete recently died. His heirs knew Pete wanted the balance of the company sold to the key employees. They happily facilitated that request. They knew Pete’s values would live on.

“It’s important to know what you don’t know,” Gene explains. “As new shareholders, we weren’t sure what the personal tax and legal impacts would be.” Coaches were provided to help the team work through these issues.

“What’s important is we treat each employee as if they are an owner. Our benefit packages are above-average for our industry. We do what we can that works for our team, keeping them engaged long-term,” Gene says. The management team believes paying employees well results in less turnover, resulting in more knowledgeable and efficient personnel who effectively create higher long-term profitability.

Keeping people engaged is what makes Willow Ridge continue on successfully.

It Was Time ….

“After 89 years it was time to close the Behnke Nursery and move on,” says Stephanie Fleming of the Beltsville, Maryland, garden center her grandparents started in 1930.

After deliberating for seven years, the family planned a Going-Out-of-Business (GOB) sale before developing the property. Behnke’s name lives on thanks to Stephanie’s passion and technology.

Customers were disappointed. From the 20,000-plus mailing list, the most common question was, “Who do I turn to now?” Stephanie started blogging to those loyal customers, promoting local garden center shopping while offering specific products through cooperating websites.

Closing the business was emotionally hard. As the news got around, their parking lot filled up. The GOB discounts started at 10% for green goods and 20% for hardware. The traffic was unbelievable. Behnke’s took delivery of six truckloads of green goods the last week of the liquidation sale

Behnke’s talked to a former Garden Center Group retailer who had used a liquidation company. That retailer warned against liquidators. The Behnke team wanted to exit the market with honesty and dignity by liquidating honest, quality inventory at fair prices while holding their heads high.

The proceeds from fixture liquidation went into an employee bonus pool for the team. Behnke alumni rallied around those employees looking for jobs to facilitate a “soft landing” into another horticultural environment. The Behnke staff’s talent and wisdom weren’t lost to the industry.

Stephanie sees the Behnke’s blog as a way to continue influencing garden center shoppers by being able to offer guidance, along with making sales through affiliate programs or commissionable links. Additionally, she’s offering her marketing services to other garden centers to help them communicate effectively.

Although the ground that once grew Behnke’s products will be put to another use, the customer list and emotional attachment to the garden center’s name will continue on as a valuable asset. GP