Hortistician Marvin Miller on the latest USDA data

The U.S. Department of Agriculture’s National Agricultural Statistics Service released both the 2019 Census of Horticultural Specialties and the Floriculture Crops: 2019 Summary last week, and both contained surprises, says Dr. Marvin Miller, our in-house hortistician, who reads between the spreadsheet lines for us. Here’s his take on the data:

While the first survey is conducted across all 50 states once every five years, the latter is conducted now in 17 states, but annually. Among the 17 states, 15 tend to be the largest states in the production and sales of floriculture crops.

In the Census, there appear to be about 12% fewer producers in 2019 than were reported in 2014, but we still have 10,939 firms identified as producers of floricultural products (out of 20,655 firms in the entire Census report, which also covers nursery crops, sod, Christmas trees, both flower seed and vegetable seed production, food crops grown under protection, and a number of other horticultural specialties). In the Floriculture Crops Summary, the respondent numbers appear to have dropped almost 19% from 2018 to 2019; there are 5,198 firms reporting in this survey.

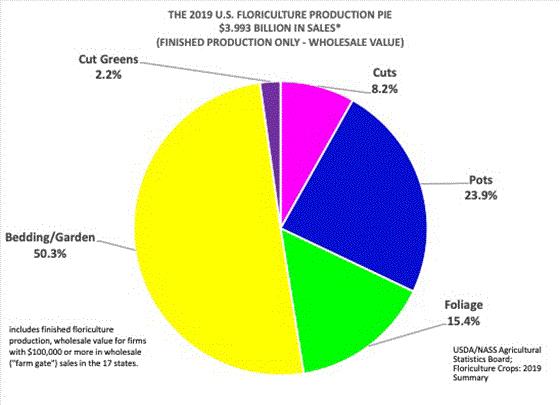

Total floriculture sales in the Census, $5.545 billion, dropped 5.7% over the five-year period from 2014 to 2019, while the Floriculture Crops Summary reported a 7.3% decline from 2018 to 2019 to $4.417 billion. Sales of finished floriculture crops dropped only 4.3% from 2018 to 2019 to $3.993 billion in the latter survey.

There was a drop in producer numbers in the Floriculture Crops Summary for every sales range, though the largest percentage drops occurred among those producers with less than $100,000 in sales; these smaller growers only accounted for 2.5% of the report’s total sales, even though they accounted for 48.6% of total grower numbers in 2019.

Among floricultural crop categories, the Census reported fewer 2019 sales for both annuals and perennials, and for foliage plants and cut flowers, with only potted flowering plants and cut greens reporting increases over the five-year period. In the Floriculture Crops Summary, only the potted flowering plant category showed sales increases from 2018 to 2019.

There are a few comments worth noting about these data at the outset. First and foremost, it is important to remember these numbers are all pre-pandemic. We certainly expect the more recent 2020 figures, which we will likely see next spring, will reflect an industry surge from the 2019 figures.

Secondly, there was a fair amount of shift taking place in the marketplace in 2019. Arguably the largest operation at the time, Color Spot Nurseries, was in bankruptcy in 2018, and it emerged from bankruptcy following the sale of its Hines Nursery division to TreeTown USA and the acquisition of the rest of the company by its primary lender, Wells Fargo Bank in August 2018. In December 2018, the remaining Wells Fargo-owned assets in California and Texas were purchased by Altman Plants, which decided to close a number of the facilities, at least for 2019 production.

While all of this was happening, we also saw a number of states legalize marijuana production, while the U.S. government legalized hemp production nationwide. As a result, a number of operations both big and small have ceased floriculture production in favor of producing some form of cannabis.

All things considered, the loss of producer numbers and production value are quite conceivable, but there will be further analysis in the coming weeks. Stay tuned.

Thanks, Dr. Miller!

Comments on the data? Email me HERE or Marvin HERE.

LiveTrends makes deal to enter European market

LiveTrends Design Group and BotanIQ Lab by Offer Madsen are joining forces by creating a new company based in Denmark: LiveTrends Design Group Europe. The deal happens January 1, with the new organization launching products into Europe in the Spring of 2021. The BotanIQ Lab name will remain a brand of LiveTrends.

BotanIQ Lab was established in Denmark in 1965 and operated under the family name of Offer Madsen until five years ago when it was rebranded to BotanIQ Lab, Intelligent Plant Design. Owned by Thomas Offer Madsen, the company produces trendy home décor with Scandinavian inspiration for the EU and UK retail markets.

LiveTrends Design Group, meanwhile, was founded in 2013 by Bisser Georgiev, the former president of Hermann Englemann Greenhouses. Its trendy product line is distributed at more than 16,000 retailers in the U.S. and Canada. LiveTrends designs more than 500 exclusive product collections annually, giving customers and consumers “a dynamic product choice that is always fresh, trendy and exciting,” they said in the press release.

LiveTrends Design Group Europe will be owned by Bisser, Thomas Offer Madsen, Søren Offer Madsen and Martin Rasmussen, with Martin as CEO and Søren as Chairman of the Board. All employees from BotanIQ Lab will remain with the new company, with Henning Brejnholt serving as COO and leading all daily operations. The organization will continue basically unchanged at its location in Odense, Denmark.

Why Europe? And why BotanIQ?

For the answers to the above, I connected with Bisser via phone.

“We’ve been thinking about entering [Europe] for the last three or four years, but we just couldn’t find the best partner for this.”

Bisser said he was looking for a partner who was already established in the marketplace, with similar core values and culture, and who understood the LiveTrends aesthetic. The partner also needed the capability to assemble products, had the supply chain in place to get them to market smoothly, and had a relationship with supermarkets and garden centers.

“BotanIQ Lab was pretty much ready. They checked all the boxes,” he said.

His second reason for making the deal? He thinks Europe is ready for LiveTrends’ products.

“There’s nobody like us there now when it comes to quick design—we produce, as you know, 500 different collections, and replace 80% every year—so our speed of design, our product portfolio, is very difficult to duplicate. And this way, we can use the intellectual property designed by our team in the U.S. and apply the exact same to Europe—use the same designs, same collections, same marketing materials, same digital tools.”

The BotanIQ Lab stand at IPM Essen 2017. Ironically, in the back are Bisser and the brothers Madsen: Søren and Thomas. If I was any good at investigative journalism, I’d have sniffed out the scoop way back then.

I asked Bisser if he thought products designed in the U.S. would work in Europe.

“Since we produce so many designs, I’m sure we can adapt many of them to Europe,” he answered. "Of course, the consumer preferences are different – for instance, Germany versus the UK have different aesthetics. But at the same time, trends are global because of social media. Whatever happens on Pinterest and Instagram here is the exact same as happens there. We’re counting on that fact.

“Of course, I’m sure we’ll get ideas from Denmark and Europe that we can apply to the U.S. market as well,” Bisser added.

And why did the Offer Madsens want to join with LiveTrends?

“They saw our success and our management, and our principles of design and how we create products, and they just love it. They said, 'We cannot do it ourselves. We can use you guys.'”

Also interesting about the deal: According to Bisser, his Urban Jungle brand of finished foliage plants will go abroad. BotanIQ Lab comes with growing facilities—“And they’re really nice, too!” he says—and they also outsource foliage from numerous quality growers throughout Europe, and they’ll continue with those relationships.

“It’s exciting,” Bisser says of this next step towards building LiveTrends into a global brand. “Our goal is to deliver joy to peoples’ homes by fusing nature and design, and the more joy we can deliver, the better!”

Bisser’s view of 2021

As we all look ahead to 2021 and speculate on what it might bring, I think about some of the smart, thoughtful folks are out there, and I reach out to them for their opinions. So while I had Bisser on the line, I asked for his take on 2021.

“I don’t think it’s going to slow down,” he said. “I believe that the stay-at-home industry is going to increase.”

He says the biggest winners from 2020 were health products, fitness, alcohol, makeup and home décor in the form of plants and landscaping.

“Those things won’t change,” he forecasts.

Even post-COVID, when a vaccine has put the worst of the pandemic behind us and we're free to travel and go out to dinner and all that fun stuff, he thinks “home-centered spending” as he calls it will remain.

“I think this year of 2020 has probably changed our psyche about being out much and hanging out in places. People are going to be scared. And this generation that is going to remember this year forever.”

Bisser’s big worry for 2021? Supply chain management and margins. He says he’s telling his team, “2021 won’t be the year of sales or marketing. It’s going to be the year of the supply chain. If you get your ducks straight in a row when it comes to hardgoods and livegoods, you’re going to be okay. But it’s all about whose got a good supply chain, not who’s the smartest marketer or the best salesperson.”

And as for margins?

“Labor is up, costs are up … we’ll see how far we can push the retails [prices] without destroying sales.”

Bonnie’s view of 2021

Another expert opinion comes from Mike Sutterer, CEO of Bonnie Plants, one of the country’s biggest nursery operations and probably the biggest supplier of consumer veggie gardening plants in the world. I emailed Mike to see if he’d share Bonnie’s take on 2021. Here’s his reply:

"At Bonnie, we’re extremely bullish on 2021. We view what happened in 2020, not as a one-year blip, but as a new 'Foundation for the Future.' For years, many publications in the industry have written countless articles wondering if, how and when the 'next generation' is going to engage in gardening. Well, in 2020, they finally did—in a big way! Over 20 million new gardeners entered the gardening category in 2020—with the majority being under 35.

"And the great news for our industry is that they generally had positive experiences that will carry them into 2021 and beyond. Our research at Bonnie suggests that over 80% of these new gardeners are going to be back in 2021—regardless of what happens with COVID—with many of them planning to grow more than they did in 2020. They found extremely positive benefits to growing plants in 2020 that went far beyond panic buying. They connected with nature, were able to share an activity with their kids, found a release from the stress of everyday life, create beauty in and around their homes, and grow something fresh to eat—all powerful motivators to bring them back in 2021.

"I think 2021 is an opportunity for us to solidify this new behavior with these new gardeners—and ensure that it becomes a habit that they look forward to year after year into the future. While some things may change in 2021 that will impact how we go about our business (like everyone working remotely, making Tuesdays feel like Saturday in the garden center), once-in-a-generation opportunity created in 2020 has provided much momentum for 2021."

Thanks for sharing your outlooks, Bisser and Mike!

What’s your opinion of what 2021 will bring? Agree with the guys? Have another view? Let me know at beytes@growertalks.com.

Plantpeddler Variety Day results

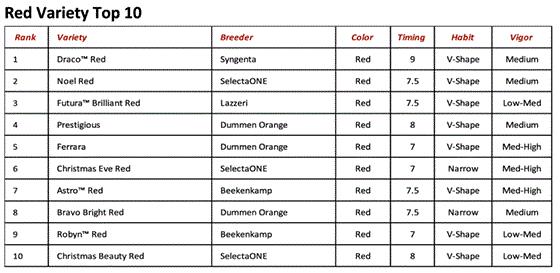

We couldn’t be there in person, but Stacy Bryant was nice enough to hook me up with a recap of the December 3 poinsettia open house at the Cresco, Iowa, greenhouse, where they trialed 144 commercial and pre-release poinsettia varieties under natural-season commercial production protocol. The attendee favorites in reds and non-reds? Draco Red from Syngenta and Jack Frost from Rinehart Poinsettias, below:

The genetics on display came from Beekenkamp, Dümmen Orange, Lazzeri, Rinehart Poinsettias, Selecta, Suntory and Syngenta Flowers. (Plantpeddler is licensed to sell liners from all the represented breeders.)

Mike Gooder, President of Plantpeddler, said, “The poinsettia trial and Variety Day event emphasizes our commitment to the industry by showcasing genetics under northern USA growing conditions. It is important to do a poinsettia production trial as a way for the industry and our growers to see how varieties perform in real-world greenhouse conditions.”

As a true production trial, the tested varieties were grown within a block of their commercial crop with the same treatments and environmental conditions. This year, the fall production conditions were warmer and brighter than average, especially during the final stages of finishing, which was the opposite of last year’s finishing weather conditions. The above-average light and warmer temps created optimal color and bract expansion in the 2020 trial block.

Trial attendees used flags to vote for “Best Red Variety” and “Best Non-Red Variety.” Here are the results:

Painted poinsettias from K&W Greenery

Another place I can’t get to this winter is K&W Greenery in Janesville, Wisconsin, which Laurie and I always visit to see their cool painted poinsettias. Since I couldn’t see them in person, I asked President Chris Williams to send me a few photos. He obliged with these colorful specimens:

I can hear you purists now, making retching sounds. Sorry, but I like them! And so do consumers. And so does K&W’s bottom line: Chris commands $17.99 for a 5 in. (an $8 premium), $29.99 for a 6 in. and $44.99 for an 8 in. (both $10 more than unpainted). Plus, love them or hate them, they get customers talking and lingering.

Some of you are like me and you appreciate a well-painted poinsettia. Send me some photos of your best gallery-worthy works of art. I’m at beytes@growertalks.com.

Finally …

You think yours has been a long career?

You’ve got nothing on Jules Janick, who on December 31 will retire from Purdue University after (drum roll, please …) 66 years!

Jules is still an active faculty member at almost 90 years young. Well, why not?!

Hortistician Marvin Miller (a Purdue alum) tells me Jules' retirement date is just three weeks shy of what would be the 70th anniversary of his arriving at Purdue as a grad student in January 1951 (he joined the faculty in 1954).

Says Marvin, “While not all of your readers may know him, a lot may know the name, as his textbook, ‘Horticultural Science,’ has been used as an introductory text for decades through the various editions. It was first published in 1963."

Congrats, Jules!

Remember, be positive, but test negative!

Chris Beytes

Editor

GrowerTalks and Green Profit

This e-mail received by 22,191 loyal readers!

Thanks to my loyal sponsors, who help me reach the 22,191 readers of Acres Online in 66 countries. Want to be one of them (a sponsor, that is)? Give Paul Black a shout and he'll hook you up.