5/1/2020

Category Growth Strategies: Creating the Plan

Bill Calkins & Steve Bailey

Because some categories no doubt have shown higher and lower potential for success, we’ll get more specific this article looking at the key category drivers in most organizations. For example, success with perennials is far different than success with statuary and how each should be approached is just as different. Let’s get started because time is money.

The Dating Game

Garden center retailers often encounter good deals at trade shows and events, and these opportunities can lead to quick dollars and higher margins than normal. But not without some risk if you’re not careful. Steve Bailey, financial expert with The Garden Center Group and his own business, RetailKPI Consulting, loves dating, but only if buyers follow this rule: All inventory purchased with dating must be sold when the final payment is made.

“The carrying cost of this (and all) inventory is calculated as 30% on top of the original cost, if you (from the time you pay it) still have the product in 12 months,” he says. “It’s basically like paying 30% interest on the merchandise.”

When he talks to garden center owners and managers and asks what they think they pay as a carrying cost, he often hears numbers ranging from 3% to 5%. This is far lower than the actual impact. At the same time, he frequently asks the same folks what they consider “bad” credit card rates. They know this answer: about 25%.

“The carrying cost at a garden center is worse,” he explains. In a real-life meeting with a client, he calculated their carrying cost at 42% when operating expenses, wages, line of credit, lost opportunity cost of money and shrink were all factored in.

Terms vs. Discounts

It’s pretty simple, according to Steve—always take the discount unless the seller is offering both. “Then you take the money and run,” Steve says. But no matter what you decide, stick to that rule in the last section: Always sell the inventory before you pay for it.

Consider this: You must be prepared to take a smaller margin once the terms of the original deal end.

“Say your terms are June 15 and you sell the merchandise by June 15. The next time you buy that product (without the beneficial discount), your margins will be lower, although your turns will increase by buying less, more frequently,” he explains. “And you will have more cash in the bank to buy.”

Buy Less and More Often

You should be buying less and more often in all categories, whenever possible. It’s more efficient. This is easier when it comes to high-turn categories like annuals, which Steve says have a “forced efficiency” when it comes to buying. But doing this across all categories, including nonperishables, will benefit your business.

Steve shares that he works with a store owner who purposely calls his woody ornamental product “woody annuals,” forcing his mindset to stay the same from product to product. Sometimes, this kind of psychology helps keep buyers on track.

Realigning Categories

“You want to have product when your customers need it and not when they don’t,” Steve says. “For example, you shouldn’t be loaded up on pottery year-round.” Look at your sales curves and plan accordingly.

One way to put this strategy into action is to flex your space. Take fertilizer, for instance. You probably don’t need the same sized display of lawn food in November as you do in April and it certainly doesn’t need to occupy the same front-of-store area.

“Reflect your changing revenue drivers,” Steve suggests. “But move other inventory into its place so the store always looks full.”

When to Double Down

When you use the knowledge gained in the first two parts of this series (March and April issues), you’ll have a good idea of what products are the most profitable, then go hard at those categories. Steve says to increase your focus on items like high-turning perishables and complementary nonperishables, and shift your mindset in this direction, while reducing nonperformers.

“Cut these over a period of three to five years,” Steve reminds. “You shouldn’t look like you’re going out of business.” Your customers will evolve with you as the product mix becomes more relevant.

Keep a close eye on specific categories, both livegoods and hardgoods, and pay attention to turns.

“The whole business model for perishable and nonperishable is very different,” Steve says. “For an uneducated buyer, margin is king and to an educated buyer, margin AND TURNS are king.”

Category Specifics

Invest more in the categories that make you money and align toward the most profitable. For the garden centers Steve studies on a weekly basis, average total revenues for annuals are 17%, while hardgoods (tools, chemicals and fertilizers) sit around 6%. This is a big difference and one that requires more in-depth discussion.

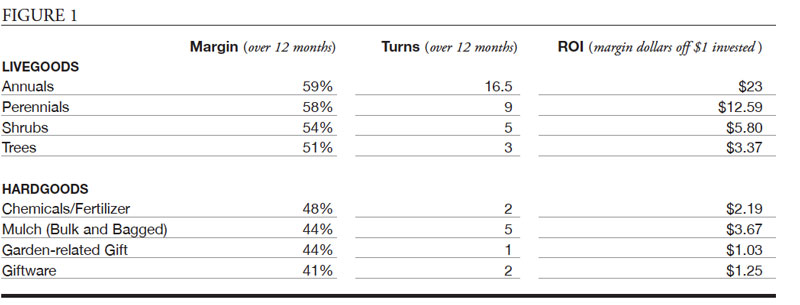

Seventy to 90 members of The Garden Center Group have participated in weekly reporting for years and Steve feels their category performance, as a whole, is fairly reflective of the industry. Let’s look at recent margins by category (Figure 1).

Figure 1:When you look at the numbers in the chart, it’s relatively clear what the money-makers are. The margins realized in just about all categories are good, but the dollars returning to your pocket as an owner look very different when turns are factored in from category to category.

Plan to Improve

When studying categories over a two- to three-year period, you’ll start to see performance trends and notice that good categories are a bigger revenue and profit driver than the lower-performing ones. Steve explains that although you should work on improving the bad categories, if they’re not getting better, just maintain them—or better yet, get out. This requires planning.

“Planning is a function of the seasonality of the category,” Steve says. “Buy within that season, turn the product and have fresh inventory the next season.”

Buy to a seasonal sales goal. To help with this, Steve is kind enough to offer three basic parameters to calculate for each category.

First, set a sales goal for the season or for the balance of the season—such as “I want to make $160,000 in revenue.” Next, agree on an attained margin goal—such as “I want to attain a 54% margin.” Finally, be sure to take into account inventory on hand. This is the basis of a solid open-to-buy system.

Let’s look at an example. Steve recommends only increasing the attained margin goal by 1% each year because the inverse of an increased attained margin percentage is an attained COGS goal, which includes shrink and discounts, etc. Multiply your attained COGS goal (inversed of attained margin goal) times your sales goal. From the resulting number, you take away the amount of inventory you have on hand. In the case above, it would be $160,000 X 0.46 = $73,600 minus the inventory on hand (at cost). That’s what you have to buy, at cost, for the season. If you have only $50,000 in relevant inventory on hand, then you need to buy $23,000 more for the remainder of the season.

“Budgets and plans are great if you constrain yourself to the budget,” Steve says. “But it’s only as good as your inventory management.” GP

Learn more about The Group at www.thegardencentergroup.com. And if you’re interested in business-specific consulting with Steve Bailey and his company RetailKPI Consulting, you can find more information at www.thegardencentergroup.com/steve-bailey-intro.