3/1/2021

Decisions by Data

Jennifer Polanz

The great thing about numbers is they don’t lie. The problem with numbers, however, is that they may not always tell the full truth or show the bigger picture. They may indicate a snapshot or a moment in time.

That’s why I wanted to take a deeper dive into the statistics we have about 2020 to see if we can glean more information from them to make key decisions in 2021. I also spoke to industry experts to get their take on how this year might go, and what strategies retailers can consider to not just maintain profitability, but grow it now and into the future.

What We Know

Based on early consumer research conducted starting in late March 2020 provided by Bonnie Plants, we know that about 16 million new vegetable gardeners entered the category at that point. According to a survey of 1,000 respondents by Scotts Miracle-Gro in April 2020, 33% were growing plants before the COVID-19 outbreak and 22% started since the pandemic began. From that survey, two-thirds (67%) said they either were growing or planned to grow edible plants.

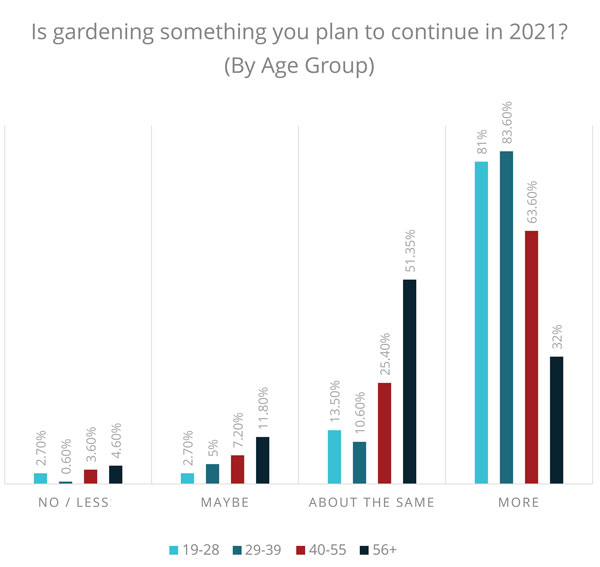

Axiom Marketing also surveyed 1,200 Americans in 2020 to gauge their gardening habits. We ran that story in the January issue of Green Profit, but to refresh your memory 86% said they would garden about the same or more in 2021. Further, 82% said they felt successful with their gardening experience and 45% said they made purchases at an independent garden center. Younger respondents (between 19 and 39) were more likely to garden again in 2021, too.

We could see results on the independent retail side, too. I asked Steve Bailey and Tim Quebedeaux, the data duo at The Garden Center Group, if there were any statistics we could share from the group numbers. From the Weekly Department Review (WDR) 2020 Year-End Report, they shared of the 81 garden centers reporting, there was an 11.3% increase in average sale over 2019, a 19% increase in transaction count and a whopping 31.6% increase in revenue. So not only were there more purchases, but increases in what they bought each time, too.

We ran consultant Ian Baldwin’s story last month, too, which highlighted data from his 5 Numbers Project, where retailers report five key metrics and compare the aggregate data. In that report, Ian told us his retailer clients saw a 20% increase in gross sales dollars, as well as an increase in gross margin dollars. He notes there was less margin leakage across the industry, and that labor expenses showed only a small increase, with some firms either flat or down.

Sam Kirkland, strategic relationship manager for Epicor Software Group, attributes general increases in margin dollars last year to reduced spending on labor and marketing (along with selling everything in the store)—two categories that are going to require more spending in 2021. Sam was one of two speakers on our recent webinar about 2021 strategies for new gardeners, along with Katie McCoy Dubow, president of Garden Media Group (find more details on that in the resources sidebar).

“We can’t maintain the businesses with the labor we had last year, so labor is going to go up and they have to market this year,” he says. “I don’t know if we can grow the same revenue, but I think we can grow the same margin dollars, so we increase prices and get a better value of what we do.”

It turns out, too, that a little luck last summer helped our industry gain more information. Dr. Bridget Behe, a researcher at Michigan State University who’s done retail-focused studies in the past, had already received some funding from Horticulture Research Institute (HRI) to study plant benefits during the summer of 2020. She was able to modify that study a bit to find out more about how consumers felt about their purchases and what their motivations were. She’s going to replicate the study in 2021, too, to see what changed.

Bridget can’t talk specifics about the study because it’s to be published in peer-reviewed journals, but she did give me a rundown on what the numbers showed. The data was broken down by Baby Boomer, Millennial and Gen Y generations. She conducted an online survey of 1,211 consumers in those generations between July 24 and August 21, 2020. The answers were compared to existing scales for topics like boredom, food security, nature-relatedness, intrinsic and extrinsic forces at play in their decisions, and whether or not their purchases delighted them. She also asked about making their plant choices based on renovating for a change or renovating to repair around the home.

“The Millennials were very prone to boredom, the Boomers were not,” Bridget noted, adding Boomers were the most food secure, so that was less of a factor in their choices. “We found some big differences on renovations for change and I think that goes with boredom. So we found that, on average, across the plant purchaser and non-purchasers, I think people engaged in about three home improvement projects.

“What was fascinating to me is the plant purchasers had almost twice the number of home renovation projects as compared to the non-purchasers. A lot of this was for change, less so for repair.”

Simple analysis: Millennials were bored and looking for ways to change things up around their homes.

Bridget also found Gen Y, which is noted to be those born between 1980 and 1994 (a group sometimes lumped in with Millennials) were more receptive to messages about the benefits of plants across the board, including their psychological, educational, social, emotional and physiological benefits.

Here she notes that Texas A&M researchers Charlie Hall and Melinda Knuth have an extensive library of resources on the benefits of plants that retailers can use for social media posts, enewsletters and more. (You can find a link to that in the sidebar of resources.)

One final note about Bridget’s study—she found people who bought both edible plants (veggies, fruits and/or herbs) and flowering plants had higher scores related to the benefits of those plants.

“What this tells me is we as professionals need to do a better job of making the pretty functional and the functional pretty,” she says, adding retailers can accomplish this by mixing edible flowers with lettuce bowls or including herbs in ornamental baskets to cross over.

Let’s Talk Social Media

Like Bridget said, a lot of the conversation about growing plants (not necessarily gardening—that’s not the preferred term among newbies) happened online. When talking with Katie at Garden Media Group about the webinar, she based her information partly on a study they conducted through a company they work with called Sprout Social. It analyzes social media handles and provided a COVID-focused analysis to all its clients. Garden Media Group got them to create a gardening subset because of all the interest on social media, and they were able to find trends in keywords and hashtags (see the sidebar on hashtags).

The categories that trended the most on social media were vegetables, kitchen gardens, seed-starting, herbs and, of course, houseplants. Notably, gardening was not one of the Top 10 keywords; they were more focused on the benefits and the conditions: beautiful, community, family, food, happy, home/house, light, lockdown, support, time and water.

How can retailers capitalize on this? “Appealing to the ‘plant nerds’ trend,” Katie says. “People want to show off their plants and aren’t afraid to learn a little science.”

More Strategies Based on Data

The one segment we haven’t talked about yet is e-commerce and that will play a role this year. There is a contingent of customers that enjoyed using online ordering and either delivery or curbside pickup. Here’s a side benefit to those online orders: “What they found this year [2020] is that the spend at the garden centers was equal throughout the week,” Sam says of the POS data retailers saw. “There was still a little surge on the weekend—it was still there—but they found that a lot of people would shop on Monday through Thursday.”

The keys are to look at your own POS data to determine how much of your sales were online and how to implement policies and procedures to make it profitable. Whether that’s requiring a minimum basket for online orders, or offering only bundles and specific products online, it’s possible to create a more profitable e-commerce presence. Bridget likened it to a restaurant takeout menu.

“Too often retailers think of it as an all or nothing proposition,” she says. “But your takeout menu does not have to be everything you have in inventory. You can have a takeout menu and I don’t think one-ofs is the way to do that.”

Sam also notes that retailers can find out more data about their customers through loyalty programs since the newer gardeners are younger (per the Axiom Marketing survey) and respond differently to marketing (per Bridget’s study).

If you don’t have good data through your loyalty program, now is a great time to start collecting that information. With many POS systems, it’s a simple process to get customers enrolled and enjoying the benefits. Then you have more actionable data to work with.

And, finally, if we look at the demand already for seeds and seed-starting products, we can extrapolate that we could see greater demand for plants this year, particularly if Axiom’s 86% make true on their word that they’ll do as much or more gardening this year. That means we have to take a hard look at pricing and sales strategies this year.

Are your traditional sales necessary to drive traffic? Is it time to raise prices, particularly because presumably you’ve spent additional money on COVID-related precautions, improvements to the store and a larger digital presence? These are questions only you and your internal data can answer.

“That’s where the progressive thinkers come in and really go ‘what do we do?’” Sam notes. “It starts with a number—this is what I need and how do I get there?

“The golden ticket was handed to this industry last year, it really was—on new customers, on shopping online. Everything is tee’ed up for an incredible year. If they want it, it’s here for them.”

More Resources For 2021

The archived webinar on “The New Gardeners: How to Keep Customers Beyond COVID-19”: www.growertalks.com/webinars

Dr. Charlie Hall’s links for the benefits of plants: ellisonchair.tamu.edu/benefitsofplants

Dr. Bridget Behe’s podcast and retail-focused research: www.connect-2-consumer.com

Hot Hashtags

The Top 10 Hashtags analyzed by Sprout Social for Garden Media Group related to gardening:

#flowerpower

#gardenlife

#growyourown

#indoorjungle

#naturelovers

#naturephotography

#succulents

#urbanjungle

#variegatedplants

#vegetablegarden