1/1/2025

Common Sense for Unknown Payroll Pressures

Bill McCurry

With the country headed in a potentially different economic

direction, old truths prevail. All payroll factors are local to your area’s economy, your business realities, and your employees’ financial situations. Let’s look at ways to lessen employee stress, without

pay raises that incur employer payroll taxes and employee income taxes.

In 1854, a wise man wrote:

“...Food, Shelter, Clothing, and Fuel; for not till we have secured these are we prepared to entertain the true problems of life with freedom and a prospect of success.” —Henry David Thoreau

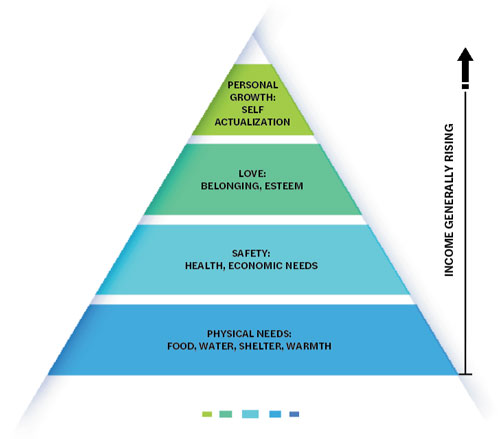

In 1934, American psychologist Abraham Maslov gave us a visual depiction of the same concept with his Hierarchy of Needs.

Most employees don’t quit jobs. They quit bosses—although they say “it’s the money,” while fleeing to a similar job elsewhere. HireHorticulture.com has an industry-wide job board and is a contract recruiter. Founder Suzanne Kludt reminds us the normal work year is 2,080 hours. Here’s a breakdown on the impact of a $2 raise at two levels of pay:

$15/hour = $31,200 annually;

$2/hour raise is $4,160 (13.3%)

$38.50/hour = $80,080 annually;

$2/hour raise is $4,160 (5%)

Suzanne pointed out, “A $2-hour raise has a different impact on higher wage earners. Managers must understand how employees respond when they’re preoccupied with basic needs, like shelter, food, etc.

“Many departing employees don’t feel respected or appreciated for the hard work they do, especially when it’s physically stressful work in adverse temperatures under deadline pressures. Thank-yous are free for bosses to give out and they pay dividends in employee retention and increased productivity.”

Other Ways to Say Thank You

There are low cost fringe benefits that some employees value:

• The most creative is a garden center that negotiated volume pricing with their heating oil company by having oil deliveries to employees’ residences billed to the center. The company then collects from employees on payday. This system saves each employee $500 to $1,200 per year. This benefit’s emotional impact on employees can’t be overstated. The only company cost is the individual monthly bookkeeping. The understandably significant benefit is one no other employer matches.

• Employee discounts cost very little because recipients likely won’t buy as much at full price. While building loyalty to your products, the discount isn’t a significant margin reduction. Liberally expanding this benefit to employees’ families can yield additional volume and more pressure on the employee to remain with you because most retailers don’t offer family/friends discounts.

• Setting up your seasonal schedule so those employees qualifying for unemployment benefits may slightly increase your unemployment insurance. However, the net cash difference to employees is very significant.

• Some retailers have reduced store hours easing employee scheduling and improving work/life balance. Most who have done this reported a sales drop, but eventually sales resumed at or close to prior levels, with meaningful payroll savings and less stress for all concerned.

Taking it to the Next Step

Some benefits cost more than others:

• Cafeteria Plans—referred to as Section 125 plans—allow employees to receive a “tax free” sum of money. Each employee can select the benefits they want for themselves and/or their family. Employers save payroll taxes.

• Employees currently receiving Social Security appreciate large Cafeteria Plan payments because they may create a tax shelter for some Social Security payments.

• Health insurance is a significant cost with few good solutions. The importance of this benefit varies widely, depending on the employee’s family status, among other issues. Explore Health Savings Accounts (HSA). Explain how employees can enroll in the Affordable Care Act (Obamacare). Diverse options and strong opinions about health care make the employee-selected choices of Section 125 plans very attractive.

• Set up Health Savings Accounts (HSA) with your employees, either as a stand-alone or with a funding option from a Cafeteria Plan.

• Retirement plans should be reconsidered. During the last decade younger employees wanted cash, not retirement plans. Green Profit’s 2024 Young Retailer finalist, Zachary Pitchford, COO/Owner of Wilcox Nursery in Largo, Florida, told us “The way people can invest in stocks and cryptocurrency today is easy. It’s download an app, connect your account, and you’re set. Young people are really more aware. We started a 401K and got amazingly appreciative comments.”

• One employer cuts $500 checks directly to each employee’s IRA. If the employee doesn’t have an IRA no payment is made.

• Many employers will reimburse educational costs if they improve the employee’s job-related performance.

• Some employers have an employee scholarship program that extends beyond job-related learning. Some of these include family members and can include degree-required courses. Like many benefits, tax-advantaged scholarships can’t favor only highly compensated employees or family members.

• We’ve heard of employers who make payments directly to the employee’s student loan account, considering it a form of scholarship payment.

• For some employees, work-from-home can be a significant benefit. It saves commute time/costs, plus it allows for eldercare or childcare that’s consistent with work production needs.

• It may be tempting to call some workers “independent contractors” to save on taxes and regulations. This is a minefield with significant state and federal risks. Get local counsel before proceeding.

• The Family Medical Leave Act (FMLA) can impose mandatory job-protected unpaid leave, depending on an employee’s specific family needs. Smaller employers may not be covered under the law. When feasible, giving employees these benefits, without being legally required, enhances appreciation for the employer.

• McKay Nursery (Waterloo, Wisconsin) is one of our industry’s leading ESOP (Employee Stock Ownership Plan) companies. The employees own the company through a trust. Their retirement is funded through the increased value and dividends of the stock. More recently Eason Horticultural Resources (EHR) converted to employee ownership. An ESOP conversion can happen at any time and does not need to be tied to any owner’s retirement. The conversion can offer tax-deferred capital gains treatment to the seller(s). Dividends paid to the ESOP are not subject to income tax, leaving more funds there to grow. Only the eventual payouts as pension income to retired employees are taxed.

The most obvious benefit is normally overlooked. Daily, garden center employees help bring health, happiness and renewal to customers. When California mandated $22 per hour for fast food workers, many garden center employees were tempted to switch jobs, but realized they would be moving from selling happiness to selling clogged arteries. While this sounds like a bad late night comedy joke, it was deadly serious.

Yes, over time many California retailers had to adjust their pay to forestall mass desertion to the fast food jobs. The reality was many employees chose to stick with the lower pay because of how they enjoyed working where they were. There’s not much joy or job satisfaction slinging grease-burgers or asking, “You want fries with that?” compared to the smiles and joy we get from beautifying neighborhoods and selling products that clean the air we breathe. GP

Note: Neither Green Profit nor Bill McCurry can offer tax advice. We are reporting what other garden centers told us they offer. Each reader must confirm with counsel to ensure an idea meets their current local and federal rules.

Bill McCurry is the owner of the consulting firm McCurry Associates. Please contact him at wmccurry@mccurryassoc.com or (609) 731-8389.