3/1/2025

Key Insights From Axiom’s 2025 Garden Outlook Study

Mike Reiber

The home and garden industry continues to evolve rapidly. Because of this, each year, Axiom completes a plethora of market research projects for our customers selling horticultural inputs, gardening, home improvement products and their channel partners.

The goal? Provide market-driven insights that help them better understand consumer needs and trends to position, message and merchandise their products more effectively to close the sale with customers.

The good news? Interest in home gardening remains robust in 2025, even as economic concerns and inflation weigh on consumers. While the percentage of respondents who spent more time gardening in 2024 dropped by 10.9 percentage points compared to 2023, nearly four in 10 (39.8%) still plan to invest more money and time into their gardens in 2025. This signals resilience in the sector, particularly among younger demographics.

The good news? Interest in home gardening remains robust in 2025, even as economic concerns and inflation weigh on consumers. While the percentage of respondents who spent more time gardening in 2024 dropped by 10.9 percentage points compared to 2023, nearly four in 10 (39.8%) still plan to invest more money and time into their gardens in 2025. This signals resilience in the sector, particularly among younger demographics.

Pictured: Opportunities for IGCs in 2025 include helping consumers accomplish their home project to-do lists.

The Rise of Gen Z and Gen Y Gardeners

Gen Z and Gen Y are at the forefront of this growth. These segments reported the greatest increases in time and money spent gardening in 2024 and have the highest expectations for increased engagement in 2025. Consider the following:

Time Commitment: 65.4% of Gen Z and 47% of Gen Y spent more time gardening in 2024. For 2025, 69.2% of Gen Z and 51% of Gen Y plan to further increase their gardening time.

Spending Growth: 46.2% of Gen Z and 43.9% of Gen Y anticipate spending more on gardening this year.

These younger segments represent a dynamic opportunity for retailers and growers to tailor offerings and marketing strategies, particularly through digital platforms where these segments frequently engage.

Independent Garden Centers: A Role Redefined

Despite the dominance of big box retailers like Home Depot, which accounted for 32.2% of gardening supply purchases and 33.9% of plant purchases in 2024, IGCs remain crucial to the market.

Consumers recognize IGCs for their high-quality plants and knowledgeable staff.

Quality Perception: 30.3% of respondents identified IGCs as the source of the highest-quality garden plants, outperforming Home Depot (24.7%).

Expertise Matters: IGC associates were rated the most knowledgeable by 25.7% of respondents, narrowly edging out Home Depot (23.7%).

Key Draws: Shoppers visit IGCs for diverse plant choices (29.9%), access to new varieties (17.4%) and expert guidance (13.8%).

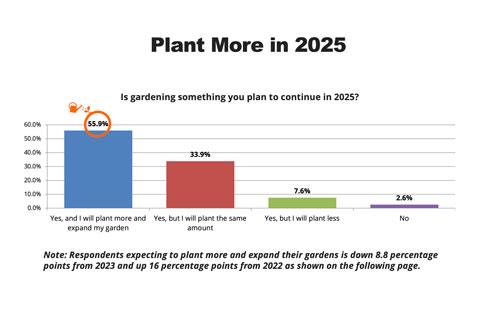

Pictured: The good news is nearly 56% of respondents said they would plant more in 2025; the bad news is that number is down nearly 9% points from last year. But there’s still time to encourage consumers to plant more this year.

Pictured: The good news is nearly 56% of respondents said they would plant more in 2025; the bad news is that number is down nearly 9% points from last year. But there’s still time to encourage consumers to plant more this year.

Addressing Consumer Needs

Our 2025 Garden Outlook Study highlights several consumer priorities that IGCs, retailers and growers should address to remain competitive. Consider the following:

1. Information Access—Websites and YouTube remain vital resources for gardening knowledge. Twenty-eight percent of respondents consider websites their primary source for discovering new plants and gardening supplies. YouTube leads among social media platforms, with 38.5% favoring it for gardening tips and trends.

2. Product Availability—38.8% wanted more flowers, fruits and vegetables from their gardens in 2024.

3. New Varieties—Awareness and availability of innovative plant varieties remain low. Retailers and growers can bridge this gap by promoting high-yield and unique plants.

Overcoming Barriers & Creating Opportunities

Two key obstacles to increased gardening were highlighted:

• Time Constraints: 40.8% cited lack of time as their primary challenge.

• Budget Concerns: Money was the second most significant barrier, emphasizing the importance of cost-effective solutions and value-driven promotions.

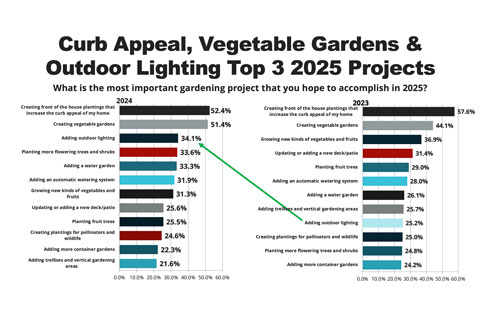

The survey identified these opportunities for gardening projects for 2025:

1. Curb Appeal Enhancements: Front-of-house plantings are popular for homeowners looking to boost their property’s aesthetic.

2. Edible Gardens: Vegetable gardening remains a core activity, driven by the appeal of fresh, homegrown produce.

3. Outdoor Living: Adding outdoor lighting and landscaping features underscores the trend of creating multi-functional outdoor spaces.

4. Project Packages: Retailers can continue curate seasonal promotions, DIY kits and plant bundles to align with the above interests. Growers can focus on producing plants tailored to these projects.

Embracing Digital Trends

With websites and YouTube leading as information sources, digital strategies should continue to be a high priority. Consider the following:

• Enhanced E-Commerce: Ensure all online platforms include detailed project ideas and plant care guides.

• Content Creation: Empower retail team members—especially younger team members to create engaging video content that educates and inspires.

• Social Media Campaigns: Target younger audiences on YouTube, Instagram and TikTok with creative, plant-centric content.

Differentiation Through Quality and Expertise

IGCs can leverage their reputation for quality and expertise by:

• Training Staff: Invest in associate training to reinforce the perception of IGCs as the go-to source for gardening advice.

• Exclusive Offerings: Highlight unique plant varieties and exclusive product lines unavailable at big-box retailers.

• Loyalty Programs: Reward frequent shoppers with discounts, exclusive access to new products and personalized gardening advice.

Mike Reiber is the Founder and CEO of Axiom. Mike helps companies identify market insights that accelerate business growth. He and his team use insights,innovation, marketing automation and content to grow sales and profits. He can be reached at mreiber@axiomcom.com. You can download a copy of the 2025 Axiom Garden Outlook Study at axiomcom.com/2025-gardening-outlook-study.

Trends & Action Plans

Below are some action points for the 2025 selling season based on Axiom’s 2025 Garden Outlook Study and its other market research work.

Trend 1: Building on Customer Confidence

Gardeners are thriving, with many expressing satisfaction in their gardening outcomes. This positive momentum creates a prime opportunity to nurture their confidence and skills with the products you sell.

Action Plan:

• Offer more workshops and in-store demos. Be sure to transform them into online tutorials that help customers tackle new gardening challenges.

• Continue to stock products that align with popular projects like vegetable gardens, pollinator gardens or native plant landscaping.

• Invest in employee training to enhance customer support and boost in-store experiences.

Trend 2: Meeting Specific Demands

Today’s customers know what they want, whether it’s a rare plant variety or a specific fertilizer. They’re willing to pay more and travel further for the right product.

Action Plan:

• Use sales data to identify high- demand SKUs and ensure consistent availability.

• Promote unique or locally sourced varieties to differentiate your inventory.

• Reward repeat customers with early access to specialty items or discounts.

Trend 3: Maximizing Yield and Beauty

Customers want more blooms, fruits and vegetables. Tap into this by emphasizing performance and yield, and explaining how this has been achieved (e.g. better genetics, better plant cultivation, etc.)

Action Plan:

• Promote top-performing plants for your region through social media and in-store displays.

• Encourage staff to share their favorite varieties and gardening tips.

• Partner with local organizations to showcase the new varieties you’re selling and to demonstrate their potential. Note: Don’t leave this up to the breeders or input providers.

Trend 4: Adapting to Changing Climates

Weather variability presents both challenges and opportunities. Concerns about water restrictions and plant resilience are top of mind for gardeners.

Action Plan:

• Highlight drought-tolerant plants, water-saving products and fertilizers designed for climate stress.

• Build relationships with water authorities to position your store as a hub for conservation solutions.

• Offer advice on watering techniques, mulching and smart irrigation systems.

Trend 5: Engaging New Audiences With Seeds

Seeds are gaining traction, especially among Gen Z and male gardeners. This trend aligns with DIY and sustainability movements.

Action Plan:

• Offer unique, heirloom and organic seed varieties along with starter kits and project kits.

• Make seed displays prominent and easy to navigate, catering to new gardeners.

• Highlight complementary products like soil, pots and grow lights to boost sales.

Strategic Pillars for 2025 Success

To thrive in 2025, garden retailers and growers must focus on five core areas:

1. Profitability: Identify and promote your most profitable SKUs. Regularly analyze sales data to refine your inventory.

2. Positioning: Differentiate yourself by emphasizing what you do best. Highlight expertise, unique products and personalized service.

3. Process: Simplify customer interactions by streamlining digital marketing, social media and e-commerce operations.

4. People: Foster a positive team culture. Invest in training and empower younger employees to lead digital efforts.

5. Place: Enhance in-store experiences by creating inviting displays, offering refreshments and designing layouts that encourage exploration.